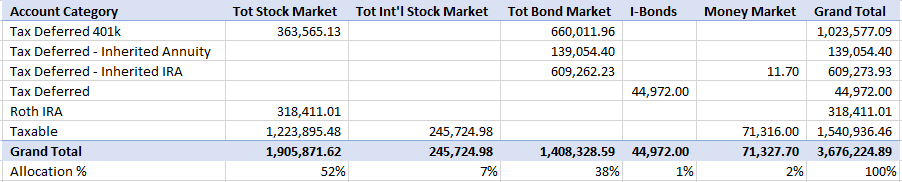

You can't avoid Sequence of Returns Risk when holding risky assets, but you can control how it manifests itself.Planning to retire soon. Below is my portfolio as of a few months ago. It's now grown to around 3.8M. I'm 63 and I'll take SS at 70 and estimate I'll receive around 45k/year. No pension or additional income. For living expenses I need around 100k/year pretax. Planning to 100 though I suppose it's unlikely I'll live that long since both my parents died at 85-86.

Based on the modeling I've done with Firecalc and the Fidelity retirement planning tool, my portfolio could withstand a 50% equity crash. However I still worry there will be a crash just as I retire. So my thought is to move $200k out of Total Bond Fund in the Inherited IRA and into something short term like treasuries or CDs. If I run this change through the retirement modeling tools, it doesn't seem to have much impact on the success of my plan. So maybe I should just do it to my reduce anxiety. I saw in some other post where Klangfool said he keeps 2-3 years expenses available in cash. I don't have an easy way to do this right now in my taxable account without creating a capital gains tax liability since I'm still working and in a high income bracket. I'd appreciate anyone's thoughts.

Take a look at amortization withdrawal methods which include VPW, ABW and TPAW all of which are available on this forum. I would recommend starting with VPW. With these methods, Sequence of Returns risk will not manifest itself as the possibility of running out of money prematurely. Instead, it will manifest itself such that your withdrawals will vary each year.

Not everybody is on board with holding any number of years in cash, by the way. I know I'm not. I hold a max of 3 months in cash because I make my withdrawals quarterly. But that's more for convenience and not for any belief that it would somehow magically save my bacon in any real way in a crash.

Cheers.

Statistics: Posted by dcabler — Tue Aug 13, 2024 5:11 am