Including the dividend yield makes a huge difference since the coupons of some of the already existing bonds were large coming into that period). Using the nominal returns in the simba dataset from 2009 to 2023 (i.e., the start of 2009 to the end of 2023) the total returns wereThose arguing that MMF have lousy long term returns relative to nominal bonds should take a look at VGLT, Vanguard's Long Term Treasury ETF. Its current principal value is more than 5% less than it was at inception in 2009 15 years ago. Significant negative returns on principal value after 14 years of investing. Obviously the picture would be brighter if we include dividend reinvestment, but most of those years were spent in ZIRP with historically low yields in LTT. Normally LTT yield more than MMF but recently we have had a multi-year run when MMF yielded considerably more than LTT. In contrast to VGLT, MMF have not lost one cent in principal value over that period and consistency produced positive yields. Not to mention that the whole way you had the safest most liquid asset that could be sold at any time in any bear market without principal loss, something that neither stocks nor bonds can claim.

Neither MMF nor bonds going forward from where we are now are going to make anyone rich in real terms. Big bond losses are behind us but gains will be slower in coming and not as dramatic as the losses IMO. It will probably take LLT a decade to climb out of the hole it dug for itself. if you need substantial returns going forward widely diversified equity including recent past winners and past losers is where to look IMO. I also do not believe that equity will continue its outstanding performance of the last 15 years, but it has a much higher potential return ceiling that bonds. In recent years the bond market suddenly switched from the greatest bond bull market in history to the most severe and abrupt bond bear in history. We don't know the future will play out, but we can be fairly sure that real inflation adjusted nominal bond returns going forward are not going to be as great as they were 1982 -2000, 38 years of ever decreasing inflation and rates. Every portfolio needs bonds (and IMO some MMF) for equity/volatility diversification but that benefit doesn't come free.

Garland Whizzer

TBills 13%

STT 16%

ITT 30%

LTT 38%

Of course the volatility was much greater for LTT (15 percentage points) than ITT (5.2), STT (1.9), or TBIll (1.3).

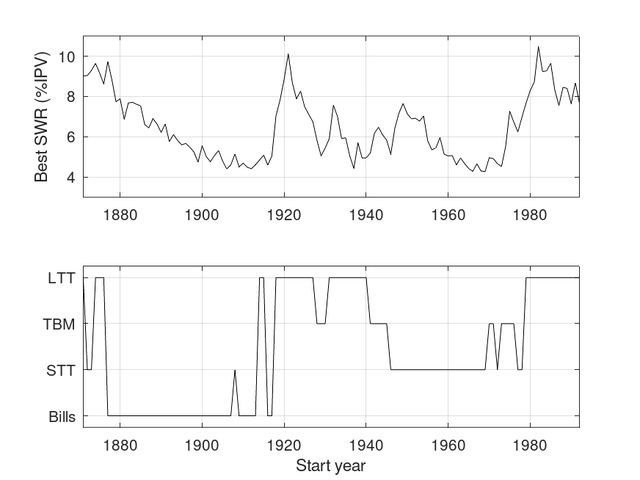

Not that I'm advocating LTT since historically long duration bonds will tend to either outperform all other fixed income (e.g., over the last 40 years or so) or underperform all other fixed income (1940s-1960s). For example, FWIW, I plotted a graph in viewtopic.php?t=412851 that looked at the best 30 year SWR using different duration fixed income as a function of start year (upper panel) and (lower panel) the duration of fixed income that produced the best SWR

As can be seen the 'best' duration varies with time. I have no idea what the future will bring, but historically short duration bonds (STT, 1 to 3 years) and intermediate (if restricted to post-1942 data for which there are some good reasons, note that TBM is similar to ITT) were rarely best, but they were never worst. There's a reason why intermediate term bonds are suggested for a single bond fund holding (although few bother to define the term 'intermediate'!).

cheers

StillGoing

Statistics: Posted by StillGoing — Thu Nov 07, 2024 3:59 am